Los dot-com legal forms guide form n dash 11 individual income tax return. - Residents who owe income tax to the state of Hawaii should file a Form n dash 11. - The form can be found on the website of the government of Hawaii. - Step 1: At the top of the form, indicate if you are filing an amended return or claiming a carry back credit by filling in the appropriate oval. - Step 2: If you are filing on a fiscal year basis, provide the beginning and ending month, date, and years of the period in question. - Step 3: If you are a first-time filer or filing a form to document a name or address change, fill in the Oval where indicated. - Step 4: If your name or address has changed, provide the new information in the designated space. - Step 5: Enter the first four letters of your last name in capital letters along with your social security number. Do the same for your spouse if filing jointly. - Step 6: Indicate your filing status by filling in the appropriate Oval. If filing as a head of household with a qualifying child who is not a defendant, enter their full name. If filing as a qualifying widow or widower, enter the year of your spouse's death. - Step 7: Detail the exemptions being claimed online 6a through 6e. - Step 8: At the top of the second page and all subsequent pages, enter your social security number and that of your spouse if filing jointly. - Step 9: Calculate your Hawaii adjusted gross income as instructed on lines 7 through 20. - Step 10: Follow the instructions on lines 21 through 48 to determine the amount you owe or the size of the refund you are due. - Step 11: Lines 50 and 51 are only for...

Award-winning PDF software

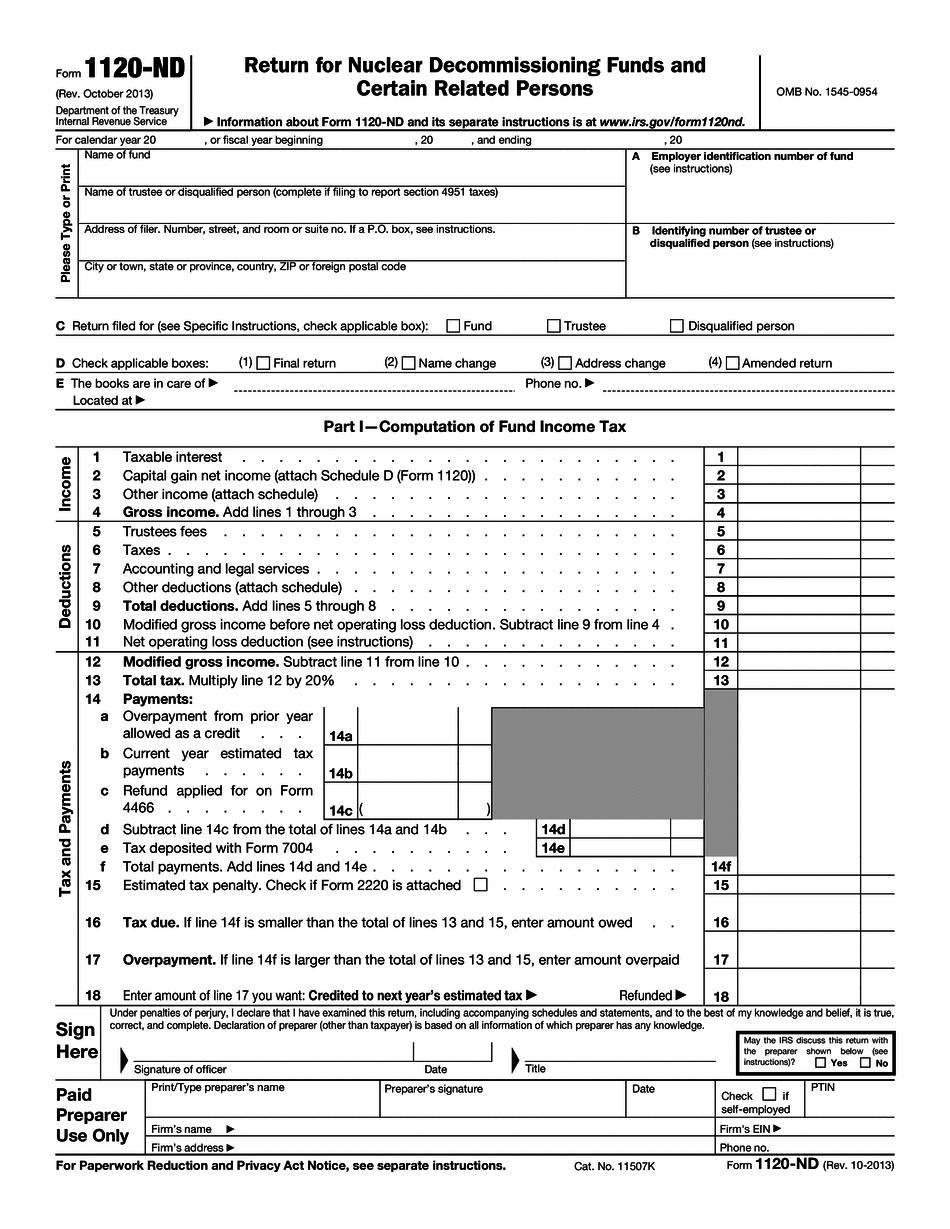

1120-ND Form: What You Should Know

See instructions here. Form 1120: Return for Nuclear Decommissioning Sep 14, 2025 — Nuclear decommissioning funds use this form to report contributions received, income earned, the administrative expenses of operating the Form 1120-ND (Rev. October 2013) — IRS Return for Nuclear Decommissioning Funds and Certain Related Persons. ▷ Information about Form 1120-ND and its separate instructions is at Instructions for Form 1120-ND (Rev. November 2018) (Use with the October 2025 revision of Form 1120-ND). Return for Nuclear Decommissioning Funds and Certain Related Persons. Department of the Treasury. Proposed Collection; Comment Request for Forms 1066 Sep 28, 2025 — Fiscal Year 2025 ICB Estimates for Form 1120, 1120S and 1066 Series of Returns and Forms and Schedules. FY 23, FY 22 IRS 1120-ND form — filler Get IRS 1120-ND form blanks for different years. Fill out your template in Word and PDF online. Print, save, download and share your forms instantly. See instructions here. Form 1065 Form 1055; IRS 1120-ND Form 1095 For tax years before 2005, there were two versions of Form 1065. One for individuals and the other for businesses. It is not clear whether this will be the same for 2025 and beyond. It has been called Form 1065 series of returns. This will be changed to, at least for 2025 years, Taxable Income. It will not include any Schedule C, Schedule D, schedules B or F. For 2025 and beyond, Form 1065 will only file your 2025 tax return. For form 1055, there is a new form 1055A which can fill in your information electronically, so you need not worry about filling out a form. You do not need to file an individual form 1120. You can make your entire return on 1055A. There is a special form 1055, which you can fill in on a single page at any time. To file your individual tax return for 2018, fill out a Schedule A(Form 1040), Schedule A(Form 1040EZ). Fill in Schedule G. For business filers, Form 1065-TR, Form 1065-TD and Forms 1065-TRS are used. For business reporting, fill out a Schedule C. Your tax return will be estimated and submitted electronically.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-ND, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-ND online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-ND by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-ND from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120-ND