Award-winning PDF software

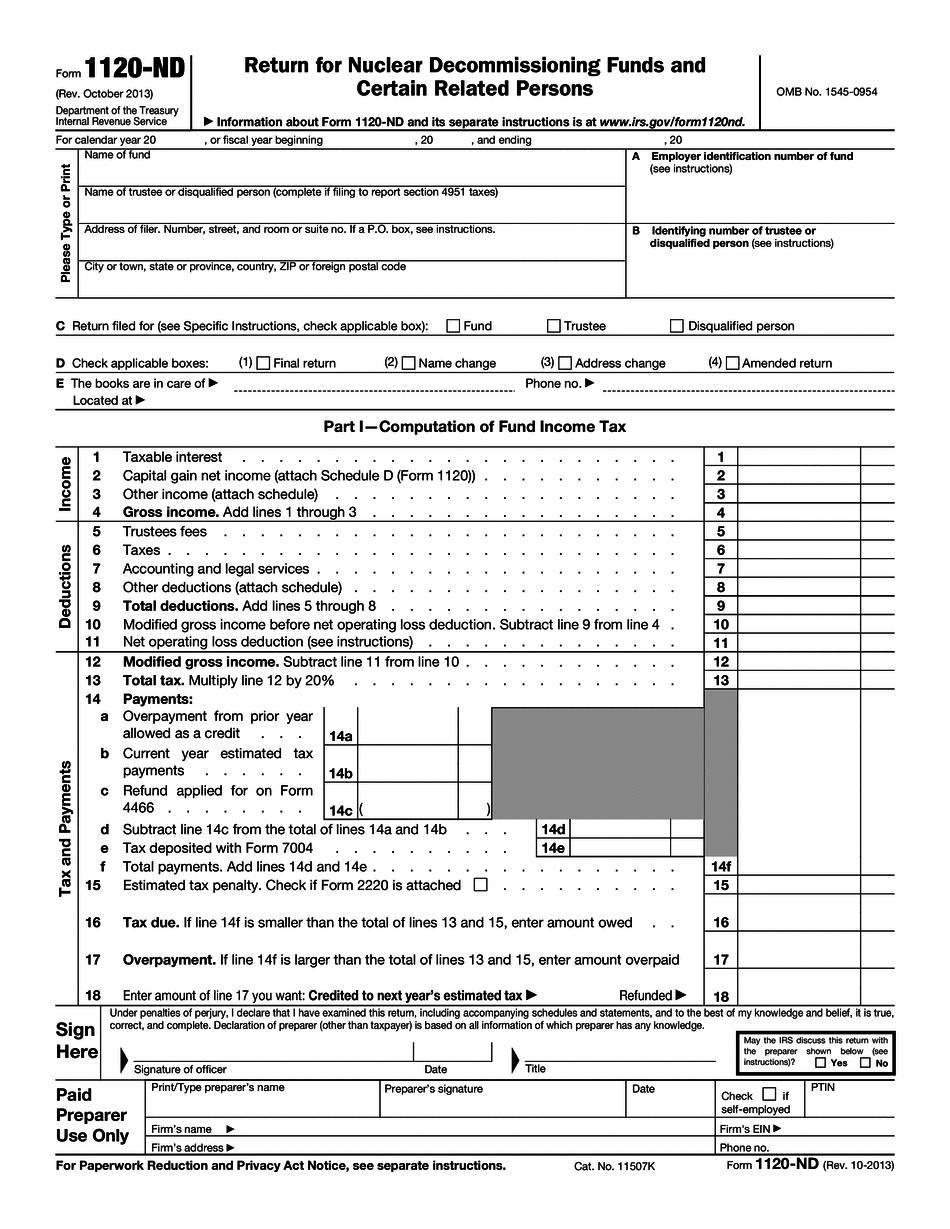

Form 1120-ND Jurupa Valley California: What You Should Know

The tax is based on the following: 1) Income; 2) Business and occupation income; and 3) Other income. △. Signature of officer. † Signed by: ‡. Date: †. Address: JURUPA USD 4850 MEDLEY ROAD JURUPA VALLEY CA 92509. The tax is based on the following: 1) Income; 2) Business and occupation income; and 3) Other income. Form 2102, Return of Distributions from Qualified Trusts for Tax Purposes What is the difference between a qualified trust and a mutual fund trust? This is a common question, but it is simple to tell the difference. In a mutual fund trust, the entire investment is in the trust which means the income is invested in the trust by a trustee that is the only owner of the investment (the owner is not called an “owner-manager” — that word is used for certain other entities such as partnerships). As such, this entity is not taxed on the income of the trust. But, the term “investment” used in a mutual fund trust includes not just funds such as index funds and mutual funds, but also investment strategies such as futures, short selling, hedging, index-creasing, and the like. The benefit is the management of those strategies which allow you to profit if the markets tank. A qualified trust has income that accrues to one or more beneficiaries who hold assets in the trust. The assets in the trust comprise a portfolio, but this cannot include more than 1,000 per beneficiary (not the amount a beneficiary can receive.) This is a huge factor because if you have 10,000 invested in the equity portion of the same mutual fund trust, you and the trustee get just 1,000 each. In a qualified trust, each beneficiary is entitled to receive a qualified distribution if the value of the portfolio drops below 1,000 for the benefit of the qualified beneficiary. A beneficiary is a person, company, or other entity, or an estate. The income to be distributed is defined in the qualified trust instrument or a trust instrument that was executed using the trust's procedures for managing income and paying distributions. It may be subject to a lower tax rate than a mutual fund trust because it is a qualified trust.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-ND Jurupa Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-ND Jurupa Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-ND Jurupa Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-ND Jurupa Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.