Award-winning PDF software

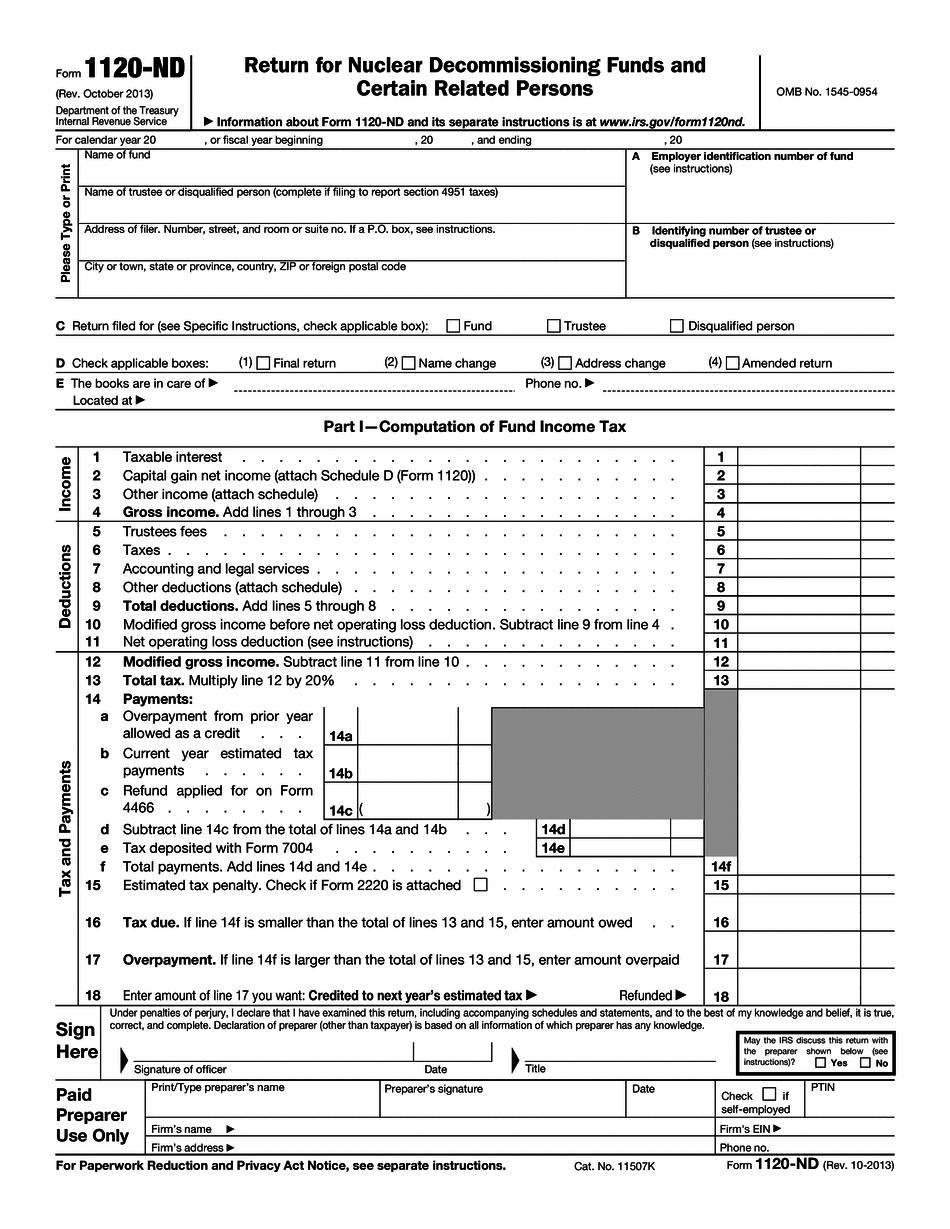

Form 1120-ND Wilmington North Carolina: What You Should Know

Excerpts from Tax Regulations, Title 1, Subtitle A Section 25-29-15, Chapter 25-29-7 §25-29-10. Definitions The terms “corporation,” “corporation and its shareholders” and “sales” as used in this chapter, means and shall be used for the purposes of this chapter: (a) Unless explicitly stated in Section 12 of this chapter, the corporation, its shareholders, and all other corporate persons and entities who own, have owned, or are related to the corporation as the case may be shall include, as a single entity or in any combination of single entities, any of the following classes of persons with respect to a business entity that does not qualify as a C corporation because of subsection (a) of Section 12 of this chapter: (1) Any owner of such an entity. If a person owns a beneficial interest in a business entity and is included in this subsection, then the business entity shall be deemed a C corporation for the purposes of this chapter. The term “beneficial interest” does not include a stock dividend. (2) Any partner with or without a partner agreement who has an exclusive beneficial or nonexclusive authority to act on behalf of, or to receive profits, dividends, or income from, such a business entity, or who by reason of his or her partnership agreement has so exclusive authority, and any member of such partner's family, who is included in the definition of “salesperson” in Title 28 of the Code of Federal Regulations. (b) The term “benefit” as defined in subsection (a) of this section shall be construed by reference to the definition contained in Section 12 of this chapter to read as follows: Benefit means any property owned directly or indirectly by a corporation or any partner or member of a partnership who is treated for any taxable year under this chapter as a shareholder of such a corporation or partnership, including any interest in property in which the partner is a beneficiary of such a corporation or partnership and any income derived from such property and which is not subject to a liability to tax under this chapter and under subsections (a) and (b) hereof for any taxable year and is subject to such a liability for any taxable year preceding the taxable year in which such property is sold or the partnership interest property is transferred or if such income is not subject to a liability to tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-ND Wilmington North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-ND Wilmington North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-ND Wilmington North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-ND Wilmington North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.