Award-winning PDF software

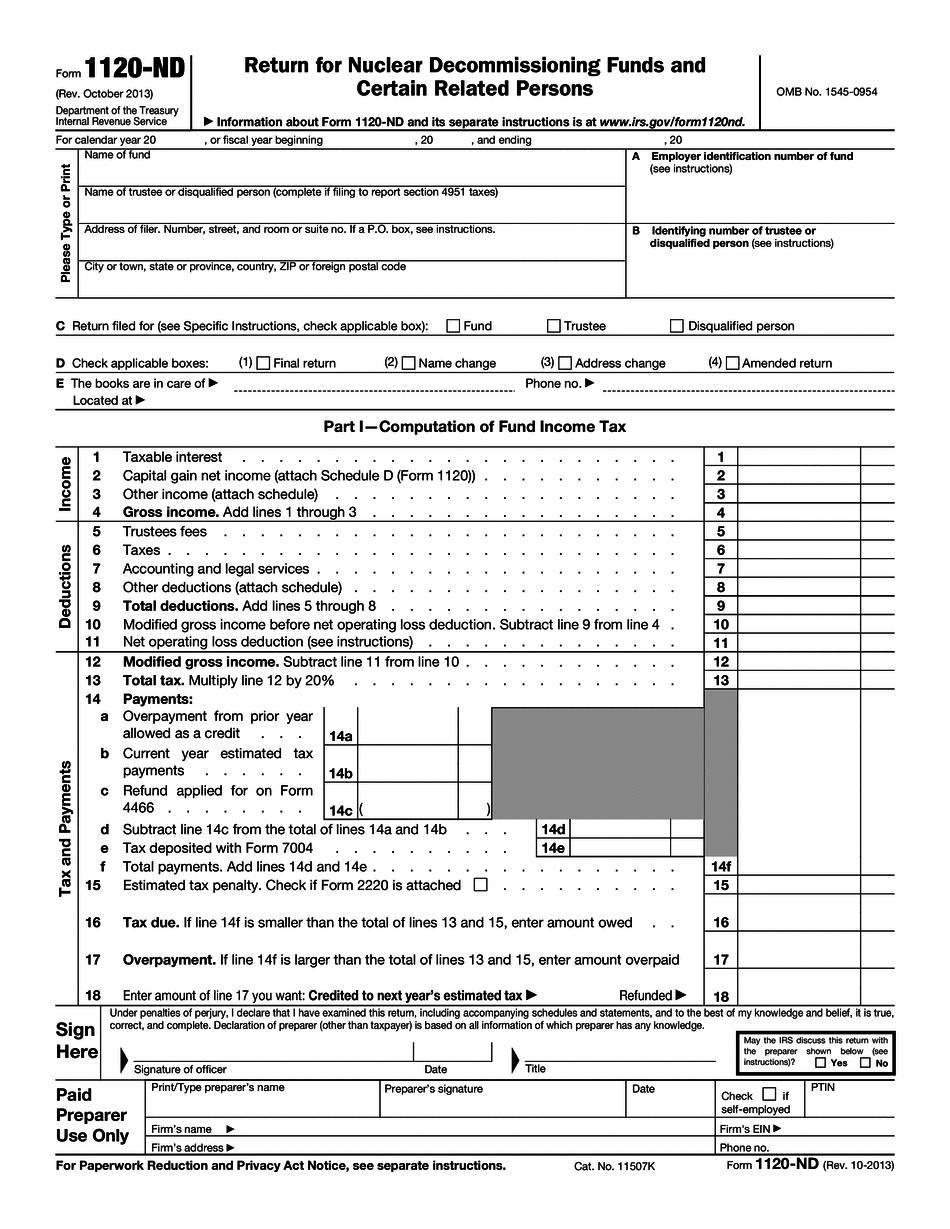

Little Rock Arkansas Form 1120-ND: What You Should Know

Use the following information to determine your tax liability Federal tax laws allow taxpayers to deduct income taxes from the amount of income from property received after May 19, 2004. For tax years after 2003, the Arkansas sales tax has been eliminated. You do not need to use an Arkansas sales tax if you have paid the regular sales tax rate at the time of purchase A corporation must report information as provided by its tax law to establish whether the corporation is subject to taxation on dividends, interest, rents and royalties. The taxpayer also must attach a statement certifying that the corporation: (1) does not meet the definition of a controlled corporation under Section 414(a) of the Internal Revenue Code; (2) has no ownership interest in the corporation by more than a person with whom either shareholder has a valid and binding contract after December 31, 2016, and prior to January 1, 2017, and the income of the related person is not subject to taxation under Section 707 of the Internal Revenue Code; and (3) has no interest in the corporation for more than a person with whom the shareholder is required to furnish a statement from the shareholder or his or her duly authorized agent under 26 U.S.C. § 1464(d)(2); and the income of the related person is not subject to taxation under Section 707 of the Internal Revenue Code because the related person is a resident of Wyoming. Corporations do not need to give the information described above to the IRS, but it must be confirmed with the shareholder. The taxpayer and the shareholder must be able to verify that the requirement to have the information in error is met, and the taxpayer and shareholder must be able to certify that the tax law requires the provision they are making. A shareholder should also be able to document the corporation's failure to comply with the provisions of the withholding provision regarding withholding tax on any payments to non-payers, including withholding on payment of dividends, interest or royalties, and the requirement that dividends be paid not later than the due date of the tax return, if timely filed, in order to obtain a rebate of withholding tax. The shareholder is not required to give the information described herein unless it is a required or required information item. If you do not have a copy of a corporation's federal income tax return, complete IRS Form SS-4, which lists the information a corporation must furnish to the Arkansas Department OF Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Little Rock Arkansas Form 1120-ND, keep away from glitches and furnish it inside a timely method:

How to complete a Little Rock Arkansas Form 1120-ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Little Rock Arkansas Form 1120-ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Little Rock Arkansas Form 1120-ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.