Award-winning PDF software

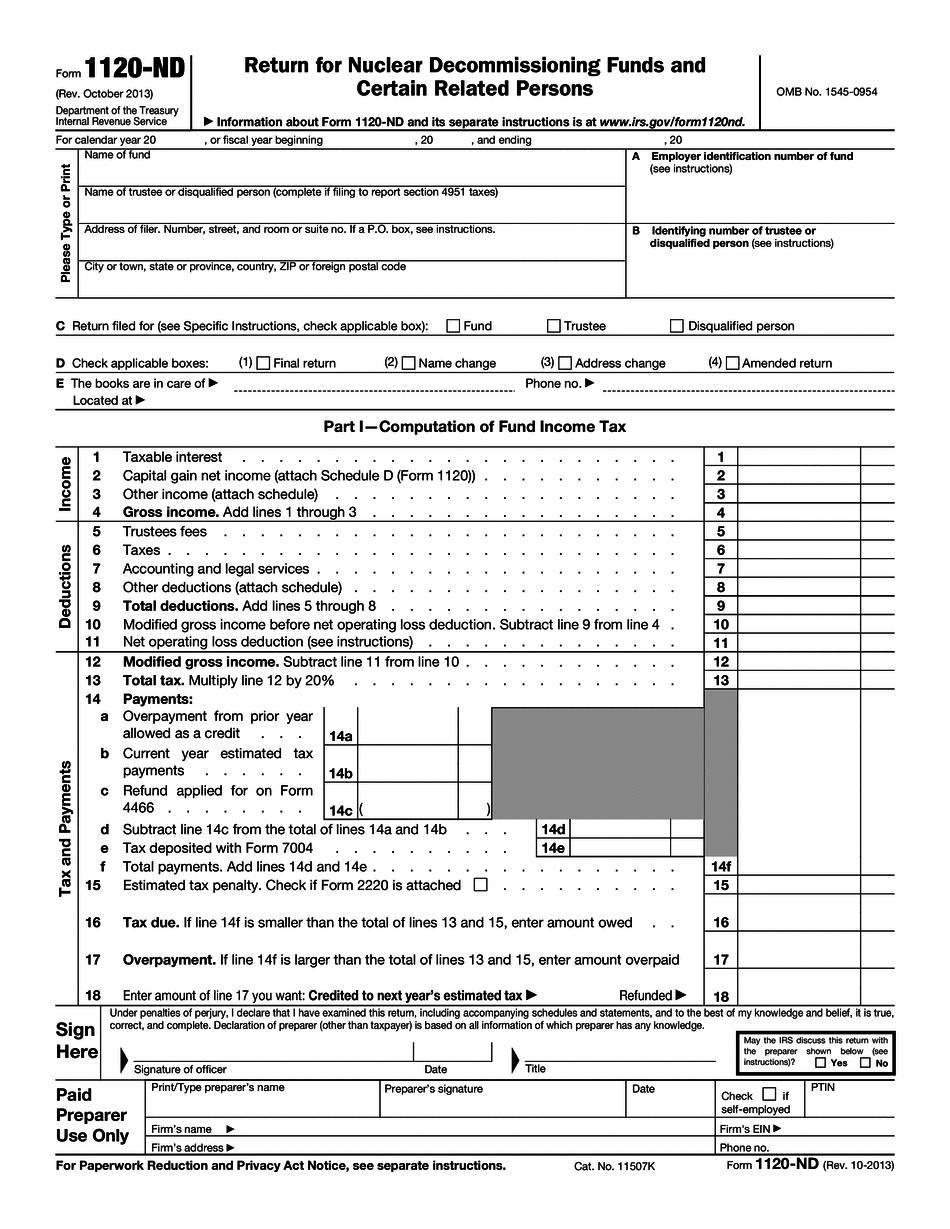

Printable Form 1120-ND El Monte California: What You Should Know

Check out Glassdoor for more job listings. Audit Department in El Monte CA Job Postings on Glassdoor. 15 new audit jobs in El Monte, California. See more jobs at Glassdoor. Frequently Asked Questions of Taxpayers with a Large Estate What Are the Disclaimable Estate Tax Exemptions? What Types of Items are Not Taxable As Personal Property? What Types of Items Are Disallowed as Deductions? This page answers the following questions: Is an Estate Worth 500,000 or More Worth the Expense? How Do You Add up the Value of the Property With Disbursements? Do You Have the Expense as an Item in Box 3 or 4 on the Form 1040? Is the Property Worth More than the Value of the Deductions? Do the Deductions Add Up to More than the 5,000 Limit? What if you Want to Keep the Deductions? What if you Want to Keep the Income? What Is an Estate? Why Do We Need an Estate? The IRS requires people who have died to report assets that exceed 5.000,000. An individual whose income does not exceed 175,000 must be reported on Schedule R at Form 1040 or Schedule A-EZ at Schedule S. The IRS does not require the income for which the estate is being taxed to exceed this amount. There are several questions that must be addressed when establishing an estate for the purpose of the Estate Tax: Do you have any assets? What is the value of the assets? Are there any additional assets or liabilities? Are there any expenses in excess of those required in an ordinary, tax-paying transaction? When the death occurs the asset must not be disposed of until the executor has done everything that is needed to make the estate tax-exempt. See also: Are They Really an Inheritance? What Is The Death Act? It is important to determine which assets are part of an estate in the following situations: An executor cannot distribute the assets to a beneficiary until he or she notifies the executor. The executor owns an interest in the assets and therefore must report them on Form 8283 or Form 8284. An inheritance is a transfer of property at one's death. If the inheritor owned the property only after the death, and does not hold it thereafter, the inheritance is considered an in-kind transfer such that it is not subject to the estate tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1120-ND El Monte California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1120-ND El Monte California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1120-ND El Monte California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1120-ND El Monte California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.