Award-winning PDF software

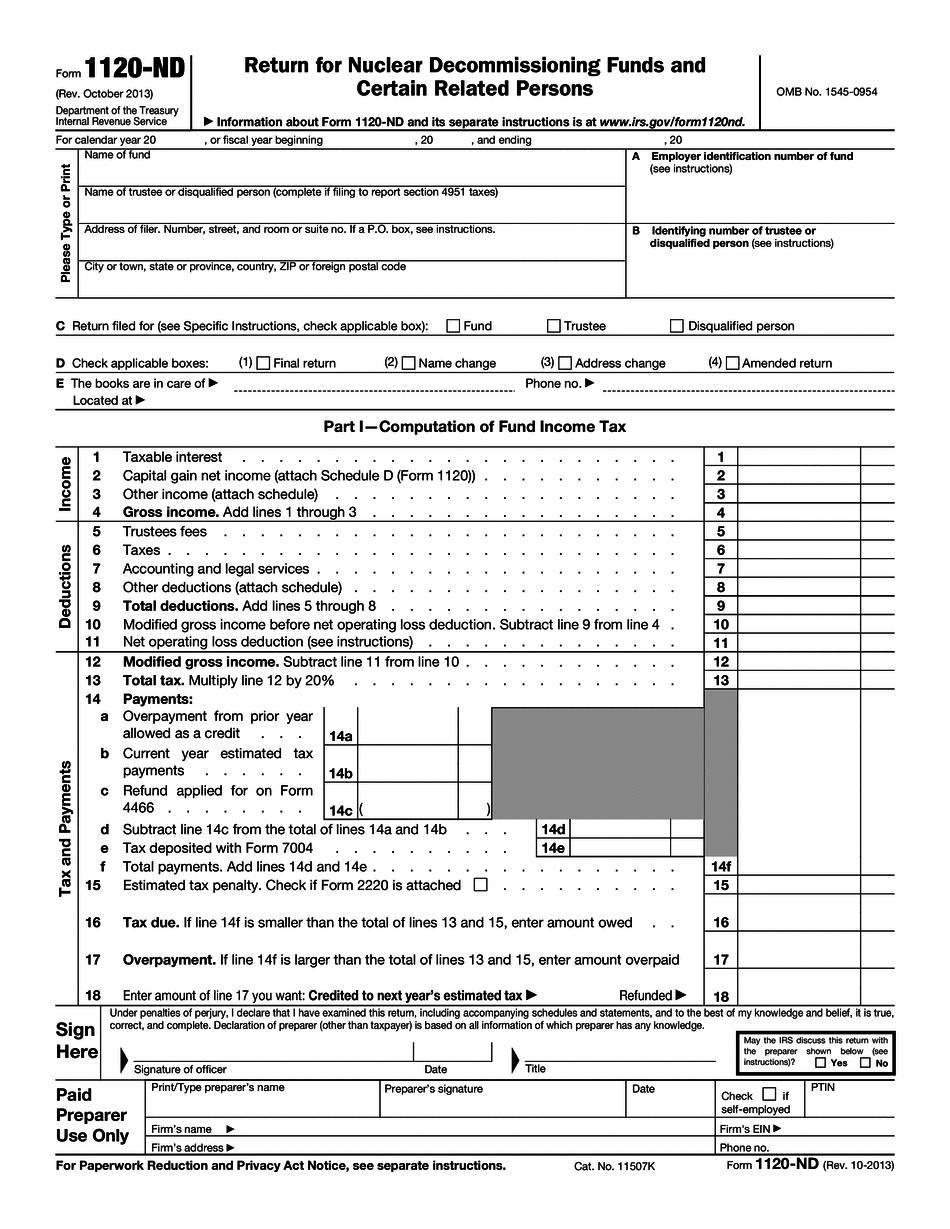

Printable Form 1120-ND Las Cruces New Mexico: What You Should Know

You can look through most forms here, check for any missing required items, and get a list of the forms that currently have a return prepared for us. If anything is missing, or you just want to ask questions, feel free to email: or call. To see how the New Mexico Income Tax is administered, select a category below. Other Topics: The most current information on the Income Tax New Mexico is found on the New Mexico Tax Division's Facebook page. Information on The Income Tax is available on the New Mexico Tax Division website. It is also found at the Department of Revenue's home page. What is the New Mexico tax code? The New Mexico tax code is the body of state, local, and federal laws and regulations that govern a state's income tax. The basic structure of the tax code is based upon a system of graduated rates that vary from zero percent through 15 percent. For purposes of income taxation, income is defined as wages paid to an individual, fees paid to an incorporated company for business purposes, and business assets sold, transferred, or otherwise disposed of by an individual. If you're an individual, and you want to do an income tax return for the year you became a resident, go to the New Mexico Division of Taxation, then go to Taxation and Revenue online. There is a link under Other Information. Enter in your marital status and number of dependents, then select “Mortgages, Taxation of, and Related Information.” The New Mexico Division of Taxation also offers tax forms for certain state tax purposes. For more information go to: Taxation and Revenue New Mexico. You can also call or visit the department's website or. You can also go on the Web at . Furthermore, you can also email. When can I file in New Mexico? The New Mexico filing deadline is April 15 if income tax is owed at the end of the year. For more information on the New Mexico income tax and filing deadlines, please consult the New Mexico Division of Taxation's website. How do I file and pay my personal income tax in New Mexico? New Mexico residents are required to complete an income tax filing and paying schedule.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1120-ND Las Cruces New Mexico, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1120-ND Las Cruces New Mexico?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1120-ND Las Cruces New Mexico aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1120-ND Las Cruces New Mexico from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.