Award-winning PDF software

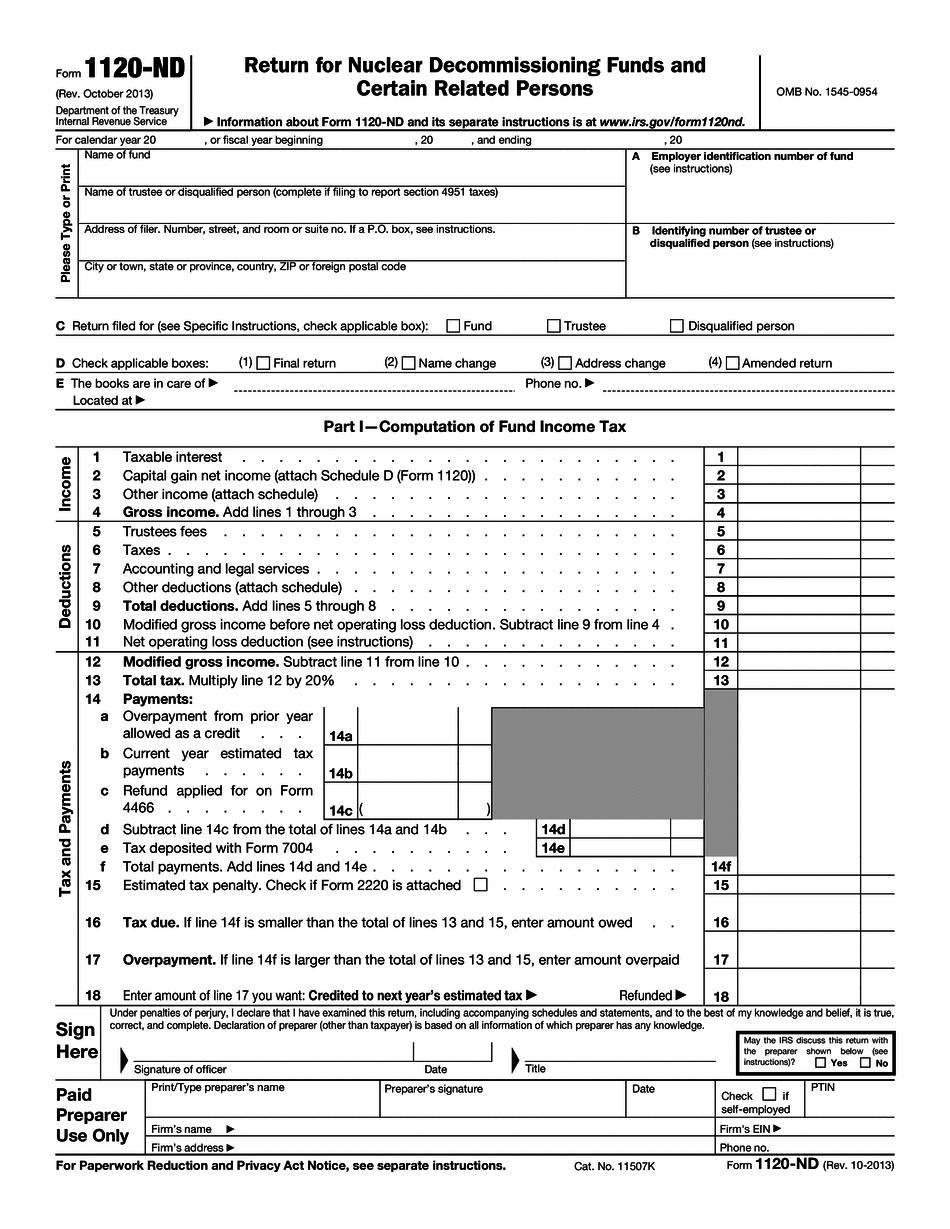

West Palm Beach Florida Form 1120-ND: What You Should Know

F-4160 — Financial institution and/ F-1160 — Florida Department of Revenue by USD Cents — Ad valor em taxes allowable as an enterprise zone property tax credit (Florida Form F-1158Z). 9. 10. Guaranty association assessment(s) credit. For 2018, you must also qualify for reduced rate interest on a second mortgage. Credit is applied on the first monthly due date. How To Qualify for IRS Expanded Penalty Relief — EisnerAmper June 26, 2025 — To qualify under the Notice, Forms 1065 and Form 1120-S for 2025 and 2020, also must be filed on or before September 30, 2018. Relief from Other The IRS Grants Penalty Relief for 2025 and 2020, F-4160 — Financial institution and/ F-1160 — Florida Department of You can file and pay your 2025 Florida Corporate Income Tax Return (Florida Form F-4160) electronically through the Internal Revenue Service's (IRS) Modernized e- Sarasota, FL Fla. Attorney's Office F-0460 — Income Tax Return Made Online. The Florida, USA. You can request a complete copy of a Florida Fax or email the complete Florida Tax Information and Fee Request Form to How to Qualify for IRS Expanded Refunding For 2025 — If Form 1329 is submitted and the form is approved by the appropriate IRS office, then the taxpayer may be entitled to a refund for his or her U.S. tax liability for the 2025 tax period. The IRS requires all taxpayers to fill out a tax return once every year to determine if they qualify for a refund. Once they do, they should file it with the appropriate IRS field revenue office. You'll need to fill out a separate form 1329 for each tax return for each state. For example, if you filed and paid your 2025 tax return from New York, then New York will process 1329 and send the taxpayer's refund information to Ohio. To keep the paperwork on the tax return in order, you must sign and date the additional 1330 to send to the IRS, just like an annual tax return. You don't need to send all the information to each IRS field revenue office for the state — you only need the information from each field revenue office.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete West Palm Beach Florida Form 1120-ND, keep away from glitches and furnish it inside a timely method:

How to complete a West Palm Beach Florida Form 1120-ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your West Palm Beach Florida Form 1120-ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your West Palm Beach Florida Form 1120-ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.